Generative AI-based Solution for “Strengthening the Three Lines of Defense (3LOD) in Banking”

Apr 01, 2025

Introduction

The financial industry drives the global economy, but its exposure to risks has led to major disruptions. Some of the most severe economic crises in history stemmed from gaps in risk management and oversight. To address these vulnerabilities and enhance risk management in banking, the banking sector adopted the Three Lines of Defense (3LOD) model. This structured framework is designed to identify, assess, and mitigate risks while ensuring transparency and accountability. But why was this model introduced, and how does it help banks navigate modern challenges? Keep reading on to know.The need for stronger risk management in banking

Banks face constant pressure from financial crises, regulatory scrutiny, and reputational risks due to inadequate risk management. The 2008 financial crisis highlighted significant gaps in risk oversight, prompting the banking industry to seek a more structured approach.- Lessons from the 2008 financial crisis The 2008 financial crisis exposed significant weaknesses in risk management practices across the banking sector, showing how fragmented oversight could lead to systemic failures. The Three Lines of Defense model was formalized to address these shortcomings by clearly delineating responsibilities and ensuring proactive risk management.

- Rising regulatory expectations In the aftermath of the financial crisis, regulatory bodies worldwide introduced stringent regulations to safeguard the financial system. The 3LOD model helps banks stay ahead of regulations like Basel III and Dodd-Frank by clearly defining roles across risk management, compliance, and audit teams.

- Complex banking operations With globalization and digital transformation, banking operations have grown more complex. Managing risks effectively now requires real-time oversight, stronger collaboration, and the ability to adapt quickly to evolving threats.

What is the 3LOD model?

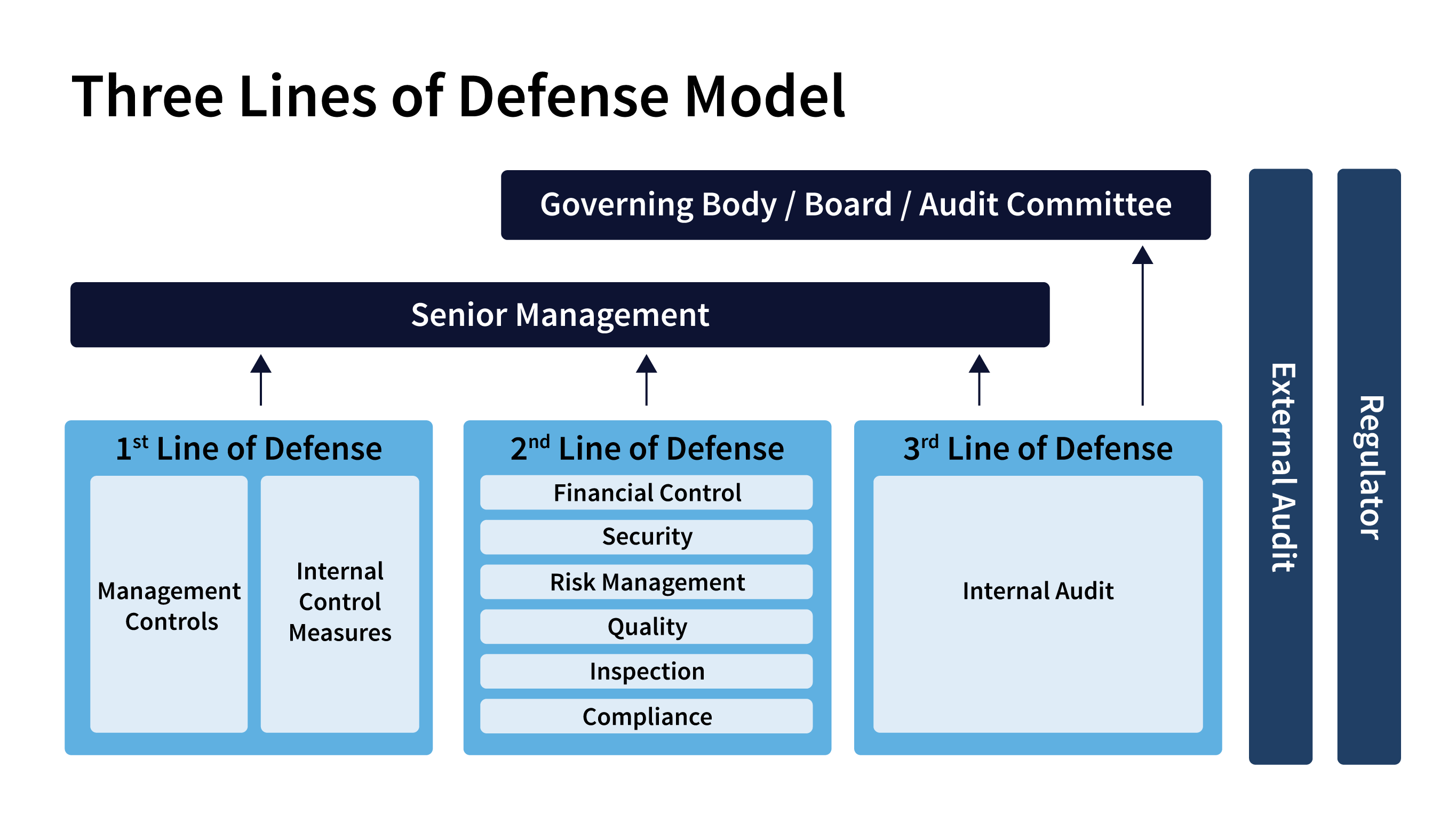

Figure-1: 3LOD

Source: The "four lines of defense model" for financial institutions - Occasional Paper No 11 The model was introduced to address several critical issues:- Clear accountability: Before the model’s introduction, risk responsibilities were often fragmented, leading to gaps in oversight. The framework assigns specific roles to each line, ensuring clarity and accountability.

- Enhanced oversight: With three distinct layers of defense, organizations can ensure that risks are thoroughly identified, assessed, and mitigated, reducing the likelihood of oversight failures.

- Regulatory compliance: In response to stricter regulations like Basel III and Dodd-Frank, the framework helps banks demonstrate a robust and proactive approach to risk management in banking.

- Resilience against crises: By embedding risk management into daily operations, oversight, and independent assurance, the model builds organizational resilience against potential crises.

- Improved governance: The model facilitates better communication and collaboration between operational management, risk oversight, and internal audit, leading to improved governance and decision-making.

Challenges in implementing the Three Lines of Defence

Even with a well-defined structure, banks face obstacles in making the model work seamlessly. Some of the key challenges include:- Defining entity relationships: Defining clear relationships between various entities can be challenging, which may dilute accountability and create inefficiencies

- Keeping up with regulatory changes: The regulatory landscape is constantly evolving, which requires continuous updates to the framework

- Data silos: Risk-related data is often scattered in silos, plagued by inconsistent formats and data governance issues

- Real-time monitoring: Effective risk management requires real-time data monitoring, which is often resource-intensive

- Compliance with data privacy regulations: Implementing technological solutions must align with data privacy laws such as GDPR or local banking regulations

- Integration of advanced tools: Adopting novel technologies such as AI and ML requires significant expertise and investment