- banner1

Overview

In recent years, the regulatory landscape under the Anti-Money Laundering (AML) Act of 2020 expanded, with the Financial Crimes Enforcement Network (FinCEN) publishing national priorities and new rules on beneficial ownership. FinCEN will also guide the use of emerging technologies like quantum computing for imbalanced data sets and machine learning for transaction monitoring. Effective AML processes now require a contextual monitoring approach, utilizing both internal and external data sources and innovative technologies to understand customer activities better, generate meaningful alerts, and improve operational efficiency. Moving beyond traditional rules-based methods, adopting intelligence-led strategies and advanced technologies is essential to combating financial crime and ensuring robust compliance.

Why quantum machine learning for financial crime compliance?

- Classical machine learning excels in predictions and classifications but struggles with highly imbalanced data.

- Limitations include reduced precision and accuracy, leading to false positives and negatives.

- Quantum machine learning (QML) leverages quantum mechanical phenomena like superposition and entanglement, which helps QML models uncover the hidden patterns and correlations between data points of complex, inadequate, and imbalanced data sets.

- It enhances classification and prediction methods, improving fraud detection and risk assessment.

Business Benefits

LTM Solution

FinCrime Detection uses quantum computing to enhance fraud prediction, anti-money laundering (AML), and transaction monitoring. Analyzing transaction patterns and consumer data improves accuracy and provides robust protection against financial crimes, ensuring regulatory compliance and safeguarding the organization’s financial integrity.

- Uses the Quantum Support Vector Machine (QSVM) algorithm for fraud detection and transaction monitoring by classifying labeled data.

- Works with a dataset containing 13 transaction attributes, 11 consumer attributes, and four historical SAR attributes.

- Improves data quality for fraud detection through thorough dataset preprocessing.

- Uses ZZFeatureMap to convert classical data into quantum bits.

- Employs Simultaneous Perturbation Stochastic Approximation (SPSA) to optimize hyperparameters for maximum accuracy.

- Applies a quantum kernel to compute the kernel matrix for accurate hyperplane construction.

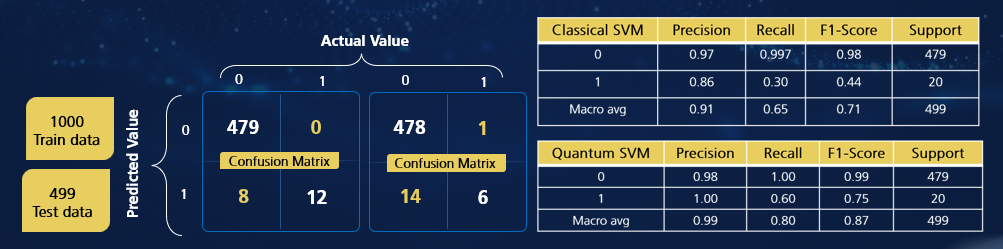

Results

Our solution demonstrated higher prediction accuracy on the IBM Quantum System for transaction fraud detection when benchmarked against a classical support vector machine (SVM).